NCAA News Archive - 2005

« back to 2005 | Back to NCAA News Archive Index

Requirement to maintain insurance certification among significant efforts to manage risk

|

The NCAA News

Terms of insurance policies -- especially details such as range of coverage and deductibles -- constantly change as the cost of health care increases and institutions face increasing risks in everyday activities.

But there are plenty of reasons to believe the pace of change is increasing. Some upcoming changes in NCAA insurance programs benefiting member institutions -- as well as an important new insurance-related condition of membership -- may be fueling that feeling.

One of NCAA institutions' most treasured membership benefits -- the Catastrophic Injury Insurance Program -- is in its second decade of providing lifetime medical benefits of up to $20 million for all student-athletes (as well as student coaches, managers, athletic trainers and cheerleaders) who are catastrophically injured during athletics-related activities.

One of NCAA institutions' most treasured membership benefits -- the Catastrophic Injury Insurance Program -- is in its second decade of providing lifetime medical benefits of up to $20 million for all student-athletes (as well as student coaches, managers, athletic trainers and cheerleaders) who are catastrophically injured during athletics-related activities.

However, the program's deductible -- which was $25,000 as recently as 1998 -- will increase August 1 for the third time in eight years, from $65,000 to $75,000.

Continuing cost pressures constantly push the national office staff -- as well as various membership committees, such as the recent Risk Management Task Force -- to seek ways to maintain affordable coverage that protects student-athletes' well-being while limiting potential liability for the Association and for member institutions.

Those efforts periodically result in changes in terms of the catastrophic-injury policy -- such as an important modification involving coverage of cheerleaders that will become effective next year (see accompanying story, page 6).

But those ongoing reviews recently sparked groundbreaking legislation, effective August 1, that will require member institutions to certify that student-athletes are covered by basic insurance that will cover the cost of athletics injuries up to at least the catastrophic-injury program's deductible.

"It's important that an athlete have some assurance that, if they're injured, they're not going to get stuck with a ton of medical bills," said Jerry Weber, head athletic trainer at the University of Nebraska, Lincoln, and a member of the Risk Management Task Force, which recommended the requirement.

Ensuring insurance

The legislation, which was adopted by Divisions II and III at last January's Convention and in April by the Division I Board of Directors, requires schools to certify that insurance exists to cover athletically related injuries, though it doesn't require that schools pay for the insurance.

Institutions can provide such coverage in whole or in part themselves, or they can require student-athletes to obtain their own insurance (taking care to obtain a policy that specifically covers athletics activity) before practicing or competing in a sport.

The certification requirement applies to student-athletes only in Divisions I and III, while Division II also requires certification of coverage for cheerleaders, student coaches, student athletic trainers and student managers.

"We didn't care how they did it," Weber said. "Some schools require all their students to show proof of insurance; that's fine. Others can't require it (for competitive or other reasons), so they're basically self-insured, and that's fine, too."

As the August 1 implementation date approaches, the national office staff is providing advice and resources for institutions as they establish certification procedures.

Juanita Sheely, NCAA travel and insurance coordinator, noted that many schools already have procedures in place that will fit well into the certification process, while some others may need to begin keeping records they've never kept before. In either case, information packets recently mailed to all institutions, combined with resources available at the NCAA Web site, should provide most of the assistance schools need to achieve compliance -- and if they don't find answers there, help from her office is just a phone call away.

Common certification questions

"Most of our institutions already were doing something, whether they bought a policy or they already had a procedure in place to make sure student-athletes had their own insurance," she said. "Certification really just mandates that, and extends this to those that weren't doing anything, which really is the exception."

The most frequent questions from schools about the certification requirement include:

* When and how often should an institution certify that coverage is in place?

"August 1 is when the rule goes into effect, but we intentionally didn't set a date by which this has to be done, because of the varying start and end times of all the playing seasons, whether traditional or nontraditional," Sheely said.

"We're just saying, make sure to do this each year before a student-athlete begins practicing or competing."

The new legislation prohibits institutions from allowing uninsured student-athletes to compete, although failure to comply is an institutional violation and carries only institutional penalties. Student-athletes will not be subject to reinstatement procedures as a result of a violation.

* Do certification forms need to be sent to the national office?

"Institutions don't have to send anything in to us," Sheely said. "The packets we mailed include a sample certification compliance form, but it doesn't have to be sent in, or even have to be used. We recommend that, however schools keep records for the institutional self-study or the athletics certification process, they also keep something on file to answer questions about whether they have done insurance certification."

* How can the institution be sure that a student-athlete possesses insurance?

"One of the hardest things about putting this requirement into place was the concern from the membership that they're not going to know, when they require a student-athlete to provide insurance, whether a parent loses or changes a job, or insurance changes or no longer applies," Sheely said. "We're going to be reasonable, as long as there's been a good-faith effort to comply."

Sheely said communication with student-athletes and their parents or guardians is the key to compliance with the certification requirement.

"One way to show a good-faith effort, when they communicate with parents at the beginning of the year -- and most schools indicate they have some sort of communication at the beginning of the school year -- is to let them know what the school is doing. For example, let them know, if you don't provide insurance for athletically related injuries, that parents have the responsibility to provide that insurance. Tell them up front, if your insurance expires or changes, you have to let us know.

"We actually have provided some forms that the student-athletes or parents or guardian can sign off on and acknowledge they know the institution does this or that, and if anything changes, they have to let the school know."

Weber, whose school is self-insured for athletics-related injuries up to $10,000 and also maintains a secondary insurance policy to supplement student-athletes' own primary coverage for costs above $10,000, said Nebraska has communicated for years with families about insurance expectations.

"We send out an insurance letter every year to our student-athletes and their parents, saying how important it is to have primary insurance to go with the limited coverage that we're able to provide," he said. "We're not going to be able to take care of Joey if he falls off his bike and breaks his arm riding across campus; if you don't have insurance, who's going to pay for those bills? So we encourage parents who do have insurance to maintain their insurance."

At West Liberty State College, which requires student-athletes to provide their own insurance for athletically related injuries to compete, the process is similar to Nebraska's.

"We do a mailing to parents every year with explicit instructions on what they have to send to us -- including photocopies, front and back, of their insurance card -- and they also sign a very clear statement that (a student-athlete) won't step on the field until we know insurance is in force," said James Watson, director of athletics at the school.

"Where some people are going to slip through the cracks is, let's say John Doe comes with insurance, but his dad loses his job and doesn't notify us. We have no way of monitoring that. But our understanding is that if we sign off in good faith -- if we've done the best we can to put this in place -- we're not expected to have a staff of detectives to run a check every week and be sure that someone hasn't slipped through the cracks."

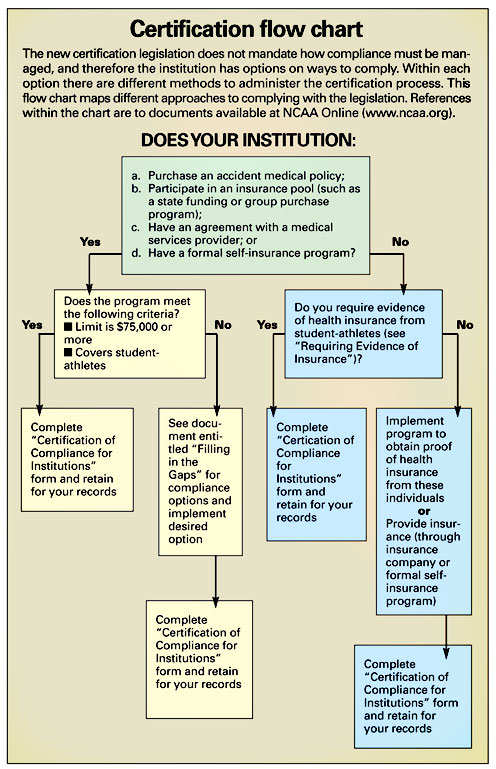

Sheely said documents created by West Liberty State actually provided a model for several of the sample forms the NCAA recently made available for institutions' use. The national office also has provided such tools as an "overview" document describing the legislation, division-specific "frequently asked questions" documents, and a flow chart suggesting ways to achieve compliance (see page 5).

"We've tried to break it down into manageable blocks of information," she said.

"I think the package the staff put together is extremely helpful," Weber said. "They've given basically everything that administrators and athletic trainers need; they'll just have to change a few names (on the forms), or a few words or lines in the statements. They've anticipated all of the variables that I think schools are going to run into.

"Most institutions should be able to take that package and adapt it to their specific needs, without a whole lot of turmoil."

Addressing the situation

That's not to suggest that compliance with the new requirement will be painless for everyone.

"I think schools that didn't have any insurance in force or didn't have an insurance requirement are going to have to scramble," Weber conceded. "They'll have to decide what to do -- are they going to require all of their athletes to have insurance, which they might, or are they just going to track those who do, then show proof that they can cover those who don't?"

Watson suggests that some schools also may find it challenging to tell student-athletes -- for the first time -- they can't practice or play intercollegiate athletics until they are insured, especially if student-athletes or their families must purchase that insurance for themselves.

"It's a matter of changing the culture, so that when a new kid comes in, it's just a requirement like any other requirement," he said. "It's the kids who don't have insurance and still have a couple of years of eligibility, and now are being told you have to get insurance to play -- they're the ones getting caught in this. But after we've cycled through this in four years, it'll be the culture at the institution, and it'll be a little easier then."

Perhaps the best result from the certification requirement, Weber said, is that every NCAA institution will be encouraged to evaluate its own insurance policies, and make decisions that ultimately will benefit student-athletes

"One thing that certification is doing: It's forcing some schools to address a situation that's been neglected," he said.

"One of the concerns of the NCAA is well-being of the student-athlete. It seems contrary to that goal if you have a kid get hurt, and you say, boy, we're sure glad you're out there playing for us, but you know, now you're on your own. You can't leave a kid hanging like that."

Future articles in this continuing series will cover such topics as why schools do or do not provide athletics-injury insurance for student-athletes, and the role that athletic trainers play in administering insurance policies.

© 2010 The National Collegiate Athletic Association

Terms and Conditions | Privacy Policy