NCAA News Archive - 2003

« back to 2003 | Back to NCAA News Archive Index

|

The NCAA News

A recently released eight-year study of Division I athletics operating budgets conducted by independent researchers implies that the relationships between spending and athletics success may not be as reciprocal as most people think. In fact, results of the study commissioned by the NCAA run counter to enough hypotheses associated with spending in college sports that the Mellon Foundation has agreed to fund further investigation.

The study is the result of a Division I Board of Directors Task Force decision two years ago to embark on a two-pronged reform effort to enhance student-athlete academic performance and fortify fiscal integrity in intercollegiate athletics. With academic reform firmly under way, the task force commissioned independent researchers to complete an economic baseline study to better understand the financial aspects of intercollegiate athletics.

Heading the data-collection and analysis team for the study were Robert Litan, vice-president for research and policy at the Kauffman Foundation in Kansas City, Missouri; Jonathan Orszag, managing director of Sebago Associates, Inc., an economic-policy consulting firm; and Peter Orszag, a senior director at Sebago and a senior fellow in economic studies at the Brookings Institute. The trio worked independently of the NCAA. Their findings show that, at least as far as operating budgets are concerned, the effects of increased athletics spending may be exaggerated.

The study looked at 10 hypotheses about college athletics, focusing primarily on Division I-A institutions, and relied on data rather than anecdotes to assess the validity of those hypotheses. The research is based in large part on a comprehensive database from school-specific information collected as part of the Equity in Athletics Disclosure Act (EADA) merged with data from other sources. The study also relies on a detailed survey of chief financial officers from 17 Division I institutions.

Findings refute two primary assumptions about college sports: that investing in athletics is the road to riches, and that the athletics "arms race" is eroding higher education. Based on analysis of current data, there is no compelling evidence to support either statement. In fact, the study shows:

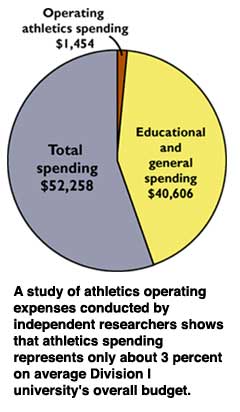

Operating expenditures for athletics are a relatively small share of overall academic spending, roughly about 3.5 percent of total higher education spending for Division I-A schools.

Increased spending on football and men's basketball produce neither an increase nor a decrease in net operating revenue, on average, over the eight-year study time span. The study finds that one dollar spent on football or basketball is associated with, on average, about one dollar in additional operating revenue.

Increased spending on football or men's basketball does not produce medium-term increases in winning percentages, and higher winning percentages do not produce medium-term increases in net operating revenue.

* There is little, if any, correlation between increased spending and increases or decreases in the measurable academic quality of students or alumni giving.

There is little evidence to indicate an "arms race," as defined by increased operating expenditures at one school triggering increases at other schools.

"At least over the eight years in the study, we can't detect a connection between spending more and winning more," said NCAA President Myles Brand. "This is a myth-breaking finding."

Researchers looked at data gleaned from the first set of EADA forms in 1993 through the most recent 2001 reports and compared operating budgets with institutions' win-loss records in football and basketball. They found little, if any, correlation. Increased spending, according to the data, did not impact schools' winning percentages during that time period, nor did increased spending affect institutions' revenues.

"Much of the rhetoric concerning intercollegiate athletics is based on two starkly opposing views," said Sebago's Peter Orszag. "One suggests that increased spending on college sports is the road to riches, and the other claims that it is the road to ruin. Although you find case studies in which either position can be validated, empirical data in this interim report suggest that neither view is correct for a broad array of schools."

The other myth-breaking finding refutes the notion that athletics operating budgets are so large that they engulf -- and corrupt -- institutional academic missions. Researchers studied data from the 1997 U.S. Department of Education's Integrated Post-Secondary Education Data System (the most recent comprehensive Department of Education data publicly available) and found that athletics spending represented about 3 percent of total higher education spending for Division I-A schools. EADA data from 2001 indicate a similar percentage.

"The Ohio State University athletics department has the highest expense budget in the country, but it's only 3 percent of what the university spends every year," said Ohio State Athletics Director Andy Geiger. "If we're wagging the dog, it's the tiniest tail in history. The study makes that clear."

Mellon to fund additional study

Though the results are eye-opening, the NCAA is calling the study an interim report because there are limitations on the data. While the study is more comprehensive than any other with regard to operating expenses from 1993 to 2001, it lacks good information on capital expenditures and coaches' salaries, two lightning rods in sports-spending discussions. The study did not intentionally ignore those two important areas, but accurate data are difficult to ascertain because of differences in the way institutions report that information.

Under the EADA, institutions are required to report the total revenues and expenses attributable to the institution's intercollegiate athletics activities, as well as the revenues and expenses attributable to certain sports (for example, football and men's basketball). But a significant shortcoming in the EADA data involves capital expenditures.

Two substantial problems arise with regard to the data on the capital stock used to support intercollegiate athletics. First, the value of the outstanding athletics capital stock is not recorded anywhere on the EADA forms. Second, new capital expenditures are not adequately reflected in the EADA data. For example, in the survey of 17 Division I-A chief financial officers, about half indicated that all athletics capital expenditures were captured by the NCAA/

EADA report, and the other half indicated that at least part was not.

"What you'll find with capital expenditures in particular is that some may be on the books of the state, some may be on the books of municipalities, and some may be for multi-use facilities where expenses are allocated among a number of functions," said NCAA Chief Financial Officer Jim Isch. "With public and private institutions using different accounting standards, it's no different than looking at higher education accounting in general. It's often difficult to compare two entities in areas other than the aggregate."

Isch said as a result of those shortcomings, the interim report was forced to focus mostly on operating expenses. While that was an appropriate approach for the time being, Isch said more than half of all Division I-A schools have either opened a new football stadium or undertaken a major renovation of their old stadium since 1990, and the interim report includes few of those expenditures.

However, the Andrew W. Mellon Foundation has agreed to contribute $50,000 for additional research in this area. The donation from the nationally renowned group that has helped fund public-interest projects for more than 50 years will fund a study of replacement-cost estimates and/or detailed insurance information at 10 NCAA institutions. The estimates from such schools would then be used, to the extent possible, to provide estimates for the replacement cost of the intercollegiate athletics capital at other schools based on a variety of factors, including square footage of playing fields and seating capacity at stadiums.

The NCAA also is working to collect more data through a task force consisting of NCAA and National Association of College and University Business Officers representatives. That group will explore a more consistent means of accounting for and reporting on athletics finances, particularly in overall compensation from all sources and capital expenditures.

The group also will focus on ensuring that new intercollegiate capital investments are properly reported in order to allow researchers to examine trends over time and to facilitate updated replacement-cost estimates in future years.

Evidence could influence behavior

The primary reason the NCAA sought assistance for further research was that the interim report is counter-intuitive enough to warrant it.

"Some of the numbers in this interim report certainly don't reflect what the general public -- or the NCAA membership -- believes," said Western Athletic Conference Commissioner Karl Benson.

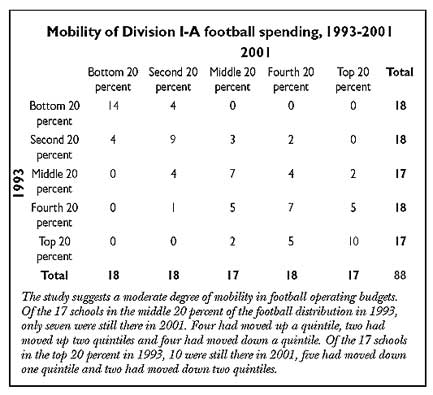

Besides refuting the assumption that increased spending prompts more wins and more revenue, the interim report also downplays the notion that the same programs are the big spenders -- and the big winners -- year after year. The study indeed shows that the amount the big spenders spend is increasing, but the big spenders aren't the same from one year to the next.

More than two-fifths of the schools that were in the top quintile of Division I-A football spending in 1993 were no longer in the top quintile by 2001. Nearly 60 percent of the schools in the middle quintile in 1993 were no longer there in 2001. More than one-third had moved up and more than one-fifth had moved down.

Net revenue also exhibited some mobility. Among the schools in the middle quintile for football net revenue in 1993, about two-thirds were no longer there in 2001.

The study also shows that increased spending doesn't necessarily lead to a better class of admissions, nor does it produce increased donations to athletics.

In the aggregate, in fact, the interim report questions whether football and basketball markets exhibit an arms race in which increased operating expenditures at one school are associated with increases at other schools.

"This study hints that the economic conditions aren't as out of line as people might believe," Benson said. "Despite what critics claim, this particular analysis shows that intercollegiate athletics is still an integral part of the institutional mission.

"While it's not the NCAA's role to mandate or dictate levels of funding, it is the NCAA's role to make sure that we always are reminded of our obligation to fit within the principles of our institutions. As institutions review their athletics programs in the near future, much like Tulane University did recently, this study will be a valuable resource."

NCAA President Brand said the study may even influence behavior. He said that though financial reform can't be driven through the NCAA -- the Association has to accommodate individual institution priorities -- the interim report can be a tool for individual schools to use in establishing and examining those priorities.

"For the college president and board, there is clear evidence that significant increases in athletics spending as the path to new revenue, better enrollment applications, more alumni giving or even more wins is far from a certain thing," Brand said. "The study says that spending, in and of itself, will not suddenly promote athletics programs to great success, nor will it plummet higher education to great ruin.

"We have a limited first cut on the data we need, but there's enough evidence here to open our eyes to look further."

Capital expense may be where arms race exists

Results from the interim report on the empirical effects of Division I athletics operating budgets will give Division I presidents and athletics administrators a better understanding of the financial aspects of intercollegiate athletics -- if they believe what they see.

What they're seeing is data that refute assumptions about college sports that are taken for granted: that spending affects winning, and that winning affects revenue. But the report is not complete (hence, the word "interim"), and some administrators want more results before being convinced.

"The dynamic in our business is with facilities," said Ohio State University Athletics Director Andy Geiger. "That's where the arms race is."

If Geiger is right, then the next step of the research should provide some enlightenment. The NCAA, through a grant from the Mellon Foundation, is working to get a better grip on capital expenditures. NCAA President Myles Brand believes that investigation -- if the data can be captured accurately -- might indicate the same result as the interim report did with operating expenses.

"Most people think that if you spend more, you win more," Brand said. "The interim report refutes that, and that is a myth-breaking finding. It is possible that a more in-depth look into capital expenditures may change this outcome, but I would not be surprised if these effects are not found. There may well also be myths about capital expenditures that should be addressed."

If there really is a facilities arms race, Geiger said it is one of rote and not choice. He said a good example is the Big Ten Conference, where many of the facilities have aged and need to be brought up to code.

"At Ohio State," he said, "there's a massive effort to make an 80-year-old stadium last another 80 years. That costs us $197 million, which is an obscene amount of money, but amortized over 30 years, it's a $14 million annual cost and the facilities we put in the stadium pay for it. So our revenue goes up commensurate with the expense side because of the way we amortized the bond. But that $14 million jump in my bottom line is not in the interim report."

Geiger also said it will be hard for any amount of research to factor in the culture that exists with some of Division I's most established programs.

"Football has been endemic to the culture of Ohio State for 80 years, which means there are not significant trends at Ohio State," he said. "There's an element of an arms race among schools we compete with as far as facilities and coaches' salaries, but the bottom-line change in operating budgets isn't all that great among those schools."

Where the interim report may have value, Geiger said, is in showing schools without the culture of an Ohio State that trying to buy it is unreasonable.

"The arms race is when schools without that culture invest millions to try to be like Ohio State, Michigan, Oklahoma and Tennessee, where all we're doing is comparing ourselves with each other," he said.

-- Gary T. Brown

* The researchers

The Division I Board of Directors Task Force commissioned the baseline economic study two years ago to address assertions that have been made about the relationship between spending and athletics success. Many have cited the so-called "Flutie effect," which assumes that athletics success produces direct and indirect benefits for schools.

In addition, some groups, including the Knight Foundation Commission on Intercollegiate Athletics, have criticized NCAA institutions for perpetuating a financial "arms race" that harms higher education.

The Board Task Force commissioned the report to provide empirical data, rather than anecdotal evidence, to address those claims.

The study was conducted by Robert Litan, vice-president for research and policy at the Kauffman Foundation in Kansas City, Missouri; Jonathan Orszag, managing director of Sebago Associates, Inc., an economic-policy consulting firm; and Peter Orszag, a senior director at Sebago and a senior fellow in economic studies at the Brookings Institute.

Litan is a former deputy assistant attorney general in the antitrust division of the U.S. Department of Justice. Jonathan Orszag previously served as the assistant to the Secretary of Commerce and director of the Office of Policy and Strategic Planning, while Peter Orszag formerly served as the special assistant to the President for economic policy at the White House.

In addition, three leading economists (each with different expertise within the economics field) reviewed the data, methods and results of the study and found the conclusions reached to be sound, the use of the data appropriate, and the analysis of the data more convincing than any to date.

"The Board of Directors Task Force felt it was imperative to obtain independent research," said Jim Isch, NCAA chief financial officer and senior vice-president for administration. "The NCAA didn't have anything to do with analyzing the data, and the independent researchers had no predisposition as to the outcome of the research. The study is what it is."

Isch also said that while the study is a resource for decision-makers, it doesn't pretend to be the definitive resource.

"This isn't about knowing the answers. It's about trying to find the answers," he said. "What we've done is put together the best data set that exists to date and we've done the analysis. Is it perfect? No. Are there areas in which we need to improve? Yes, and we're trying to do that by gathering better information on capital expenditures, with the help of the Mellon Foundation, and to have tighter definitions so that when the institutions submit numbers in the future, they'll be as accurate and as consistent as we can make them."

* The hypotheses

The study looked at the following 10 hypotheses about college athletics, focusing primarily on Division I-A institutions, and relied on data rather than anecdotes to assess the validity of different hypotheses.

No. 1: Operating athletics expenditures are a relatively small share of overall academic spending. Confirmed. Data show athletics spending is roughly 3.5 percent of total higher education spending in Division I-A.

No. 2: Football and basketball markets exhibit increased levels of inequality. Confirmed. Data show an increase in the spending gap between the "haves" and the "have-nots" during the eight-year period.

No. 3: Football and basketball markets exhibit mobility in expenditures, revenue and winning percentages. Confirmed. The top spenders aren't always the same from year to year, nor are the top winners.

No. 4: Increased operating expenditures on football or basketball, on average, produce no medium-term increase or decrease in operating net revenue. Confirmed. In other words, a dollar spent means a dollar gained.

No. 5: Increased operating expenditures on football or basketball do not produce medium-term increases in winning percentages, and higher winning percentages do not produce medium-term increases in operating net revenue. Confirmed. Over the eight years in the study, there doesn't seem to be a connection between spending more and winning more.

No. 6: The relationship between spending and revenue varies significantly by subgroups of schools (for example, conferences, schools with high SAT scores, etc.). Not proven. The study shows no indication that increased spending under a specific set of characteristics will increase revenues or increase winning.

No. 7: Increased operating expenditures on big-time sports affect operating expenditures on other sports. Not proven. The study suggests that each dollar increase in operating expenditures on football among Division I-A programs may be associated with a $0.21 increase in spending on women's sports (excluding basketball) and a $0.35 increase (including basketball).

No. 8: Increased operating expenditures on sports affect measurable academic quality in the medium term (such as SAT scores of incoming students). Not proven. There is some connection between increased spending in football and an increase in applications for admission, though no connection to the quality of those applications.

No. 9: Increased operating expenditures on sports affect other measurable indicators, including alumni giving. Not proven. Data show no robust relationship between increased spending and alumni giving either to the sports program or to the university itself.

No. 10: The football and basketball markets exhibit an "arms race" in which increased operating expenditures at one school are associated with increases at other schools. Not proven. Some analysis suggests this phenomenon exists among schools within the same conference, but other specifications suggest no relationship. The existence of an arms race may be concentrated in capital expenditures, which are not adequately recorded in this research, rather than in operating expenditures.

© 2010 The National Collegiate Athletic Association

Terms and Conditions | Privacy Policy